Monday Morning: The Weekly Forecast Call

(Supply Chain vs Sales……)

It’s Monday, right? So, we know what that means don’t we?

Yes, it’s the Weekly Forecast Call!

The highlight of your week? Maybe not.

Colleagues representing supply chain, ops, sales, finance, even the boss has turned up. We’re all friends, right? I mean, we did a virtual coffee-cup-clink….

Now, repeat after me:

“Thou shalt not lie regarding realistic sales targets”

“Thou shalt not expedite more product than will reasonably ship by quarter-end”

“Thou shalt not work deliberately against the opposing team to justify worth and budget”

No one’s got good data. It’s a difficult place. The battle lines are drawn.

All feel they must find their scapegoat somewhere in the room and do so with superior virility than their opposite number.

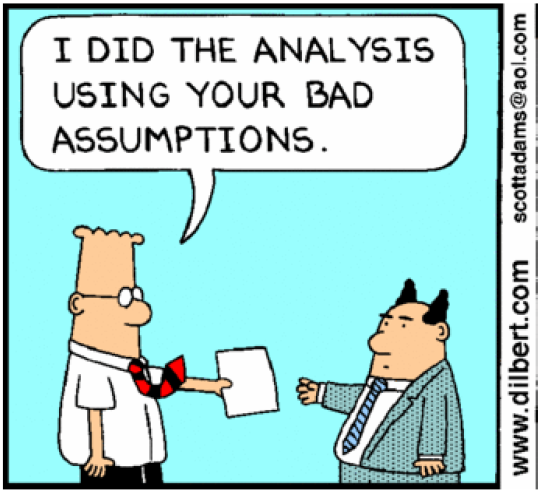

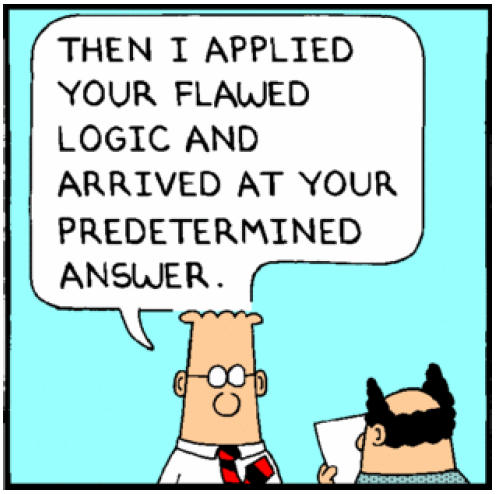

The figures look worrying (the figures always look worrying), studious facial expressions set while S&OP the analysis is delivered.

No one understands what was just said

We’re just waiting for the forecast bit, sales segment managers re-check their spreadsheets (what’s my upside?!?).

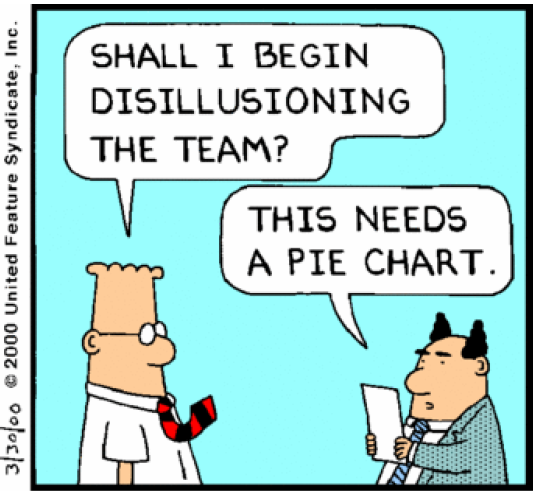

It feels like a battle of nerves.

Will sales crack first and reduce their forecast?

Will the supply chain hesitate when questioned on SKU availability?

Will Finance remind everyone of what an increase in deferred revenue means for shareholder confidence?

Who’s winning?

Sales are out of the traps quickly:

“The demand’s there, our pipeline’s strong!”

Supply Chain interject. “Is that an SFDC extract, Bob?”

“No, it’s….” Bob hesitates. “….it’s a working file. I’m maintaining it in Excel.”

“Right.”

Finance’s turn.

“Phil, I know you went through the deck quickly, but I saw we’re tracking $30 million over our shipment target QTD. How’s that possible when key products aren’t available in the warehouses?”

My word, that’s a good question.

A cleared throat, a swipe through the slide deck. Phil’s stalling.

“It’s a demand issue. Hospitality is opening back up. There have been some spikes…”

Suddenly there’s a glint in his eye:

“I think it might be soft orders on project business….has the sales the pipeline been interrogated? We have to guide manufacturing; they can’t make a million of everything every week!”

What a comeback. Didn’t even need to pull an “Extended Lead Time List” out of the Supply Chain Box of Tricks.

Over to Bob in sales.

He’s is visibly sweating.

His team needs him to respond – He’s their leader.

Bob looks at his forecast, he senses the oppressive stares

“We need to run some analysis….”

His team slumps. Week 9 has been given to Supply Chain.

More training is required. They must bounce back next week.

But the issue is with data and how to process it in a way that provides you with the insight you need to make boardroom decisions. Don’t fall into the management trap….

Now, the Serious Part…..

Although this has been a fun parody, there is common ground between the folk who are driven by sales targets and those driven by shipment forecasts.

It’s all about predicting the future.

Together it can be achieved but separately you will fail.

Neither knows the others’ business; neither knows what the other does not.

Monday forecast calls reveal new information: the extent of product lead-time extensions, of sales forecast accuracy, of target re-engineering, of product, expedite opportunities. It feels like a 7-day battle.

But what if the importance of these issues was correctly assessed?

What if the POS risk was successfully displayed?

What if the deferred revenue was sufficiently maintained so that financial controllers were comfortable with both sales and supply chain personnel and gave their recommendation to the board reflective of your advice?

I’ve written many times about how to become better empowered by channel data.

Please contact me or read through below, and look out for more articles supporting channel data enablement.

Building Success:

What are the approaches and tools?

If you would like to find out how specific channel tools can support you and your teams better, and learn more detail around exactly how they help, myself, TPC Global, and our tools and methodologies will continue to exist, enhance and support channel teams across the globe

With complex organizations, requirements become very specific. With every channel client, we’ve worked with, our approach is to adapt what we do to meet their specific needs.

Tools and methodologies covered include the following subject range:

➢ Distribution Optimization

➢ QBRs & Strategic Reviews

➢ Reseller Analytics

➢ Inventory, S&OP & ROP

➢ Channel Marketing & Programs

➢ Competitive Pricing & Analytics

➢ eCommerce Growth

➢ Incorporating Amazon into Your Channel

You will find that going through this process will stimulate your mind and, quite apart from considering other people’s great ideas, you will start to have great ideas yourself.

David Porter, CEO & Founder

TPC Global

Distribution Optimization | Reseller Analytics

PriceMark eCommerce | PriceMark Amazon